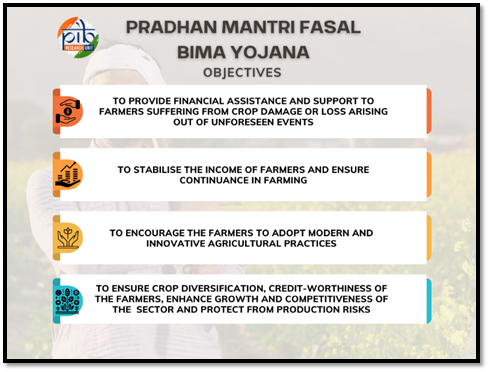

On February 18, 2025, Pradhan Mantri Fasal Bima Yojana marks its nine-year anniversary, celebrating close to a decade of empowering the farmers of India. Launched in 2016 by Prime Minister Shri Narendra Modi, the scheme offers a comprehensive shield against crop losses caused by unpredictable natural hazards. This protection not only stabilizes farmers' income but also encourages them to adopt innovative practices.

Crop insurance is an important risk mitigation tool to protect farmers from natural calamities. It aims at providing financial support to farmers suffering crop loss/damage arising out of natural calamities like hailstorm, drought, floods, cyclones, heavy and unseasonal rains, attack of disease and pests etc.

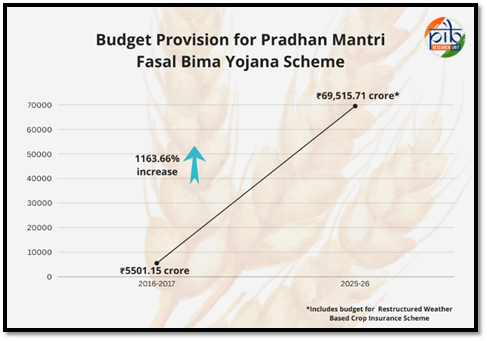

Witnessing the success and potential of the scheme, the Union Cabinet in January 2025 approved the continuation of Pradhan Mantri Fasal Bima Yojana and Restructured Weather Based Crop Insurance Scheme till 2025-26 with a total budget of ₹69,515.71 crore.

Restructured Weather Based Crop Insurance Scheme (RWBCIS) is a weather index-based scheme, which was introduced along with PMFBY. The basic difference between the PMFBY and RWBCIS is in its methodology for calculation of admissible claims to the farmers.

Technological Advancements

- Pradhan Mantri Fasal Bima Yojana (PMFBY) envisages use of improved technology including satellite imagery, drones, Unmanned Aerial Vehicle (UAV) and remote sensing.

- This is for various applications such as crop area estimation and yield disputes and also promote the use of remote sensing and other related technology for Crop Cutting Experiments (CCEs) planning, yield estimation, loss assessment, assessment of prevented sowing areas and clustering of districts.

- This enables more transparency, accountability and accuracy in loss assessment and timely payment of claims.

- Capturing crop yield data/Crop Cutting Experiments (CCEs) via the CCE-Agri App for direct upload to the National Crop Insurance Portal (NCIP), allowing insurance companies to witness the conduct of CCEs, and integrating state land records with the NCIP.

- Further, for timely and transparent loss assessment as well as timely settlement of admissible claims YES-TECH (Yield Estimation System Based on Technology) has been introduced from Kharif 2023 after discussions with stakeholders and technical consultations. YES-TECH enables large scale adoption of technology-based yield estimates for yield loss and insurance claim assessments under PMFBY. The purpose is to blend the technology-based yield estimates with manual yield estimates and reduce the dependence on manual system gradually.

Key Benefits

- Affordable Premiums: The maximum premium payable by the farmer will be 2% for the Kharif food and oilseed crops. For rabi food and oilseeds crop, it is 1.5% and for yearly commercial or horticultural crops it will be 5%. The remaining premium is subsidized by the government.

- Comprehensive Coverage: The scheme covers natural disasters (droughts, floods), pests, and diseases, along with post-harvest losses due to local risks like hailstorms and landslides.

- Timely Compensation: PMFBY aims to process claims within two months of the harvest to ensure that farmers get the compensation quickly, preventing them from falling into debt traps.

- Technology-Driven Implementation: PMFBY integrates advanced technologies like satellite imaging, drones, and mobile apps for precise estimation of crop loss, ensuring accurate claim settlements.

Risks Covered

- Yield Losses (Standing Crops): The Government provides this insurance coverage for yield losses that fall under the non-preventable risks such as Natural Fire and Lightning, Storm, Hailstorm, Tornado, Flood, Inundation and Landslide, Pests/ Diseases, Drought etc.

- Prevented Sowing: Cases may arise where most of the farmers (insured) of notified areas may want to plant or sow. In such cases, they have to bear the expenditure for that cause and are restricted from planting or sowing insured crops because of unfavourable weather conditions. These farmers will then become eligible for the indemnity claims of up to a maximum of 25% of the sum insured.

- Post-harvest Losses: The Government provides for post-harvest losses on an individual farm basis. The Government offers coverage of up to 14 days (maximum) from harvesting for crops that are stored in “cut and spread” condition.

- Localised Calamities: The Government provides for localised calamities on an individual farm basis. Risks such as loss or damage arising from identified localised hazards, such as hailstorms, landslides, and inundation impacting separated farmlands in the notified area comes under this coverage.

Strengthening the Pradhan Mantri Fasal Bima Yojana

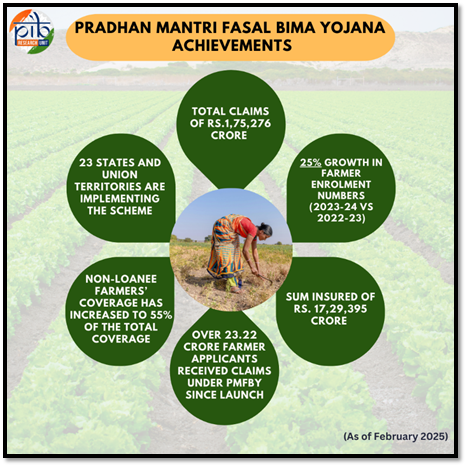

The Government has made several interventions for ensuring better transparency, accountability, timely payment of claims to the farmers since its launch in 2016. As a result of which, the area and farmers covered under the scheme in 2023-24 are at all-time high. The scheme is now the largest in the world in terms of farmer applications. Some States have further waived off farmer’s share of premium due to which there is very less burden on the farmers.

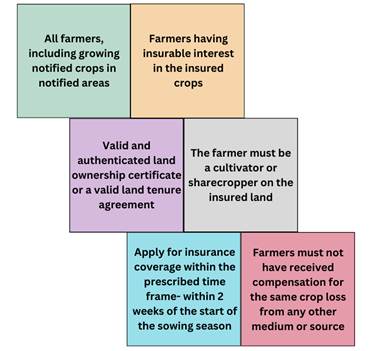

Eligibility

Though the scheme is voluntary for farmers, non-loanee farmers’ coverage has increased to 55% of the total coverage under the scheme during 2023-24, which shows the voluntary acceptability/popularity of the scheme.

Application Process

https://sansad.in/getFile/loksabhaquestions/annex/184/AU269_UCTI1z.pdf?source=pqals

Conclusion

Over the past nine years, the Pradhan Mantri Fasal Bima Yojana (PMFBY) has transformed Indian agriculture by providing farmers with a comprehensive safety net against crop losses due to natural calamities. By leveraging advanced technology, the scheme has improved transparency, accuracy, and efficiency in crop loss assessment and claim settlement. With affordable premiums and extensive risk coverage—including yield losses, post-harvest losses, and localised calamities—the scheme has become a crucial support system for farmers, ensuring timely compensation and stabilizing their income. The increased voluntary participation, particularly among non-loanee farmers, highlights the growing trust and acceptance of the scheme. As the PMFBY moves into its next phase, it continues to empower farmers and strengthen India’s agricultural resilience.

References:

- https://pib.gov.in/FactsheetDetails.aspx?Id=149055®=3&lang=1

- https://static.pib.gov.in/WriteReadData/specificdocs/documents/2021/jul/doc20217111.pdf

- https://pib.gov.in/PressReleasePage.aspx?PRID=2089410

- LOK SABHA UNSTARRED QUESTION NO.2344

- https://pib.gov.in/newsite/PrintRelease.aspx?relid=148441

- https://pib.gov.in/PressReleasePage.aspx?PRID=2089410

- https://pib.gov.in/PressReleasePage.aspx?PRID=2085179

- https://www.myscheme.gov.in/schemes/pmfby

- https://www.myscheme.gov.in/schemes/pmfby#benefits

- https://sansad.in/getFile/loksabhaquestions/annex/184/AU269_UCTI1z.pdf?source=pqals

- https://sansad.in/getFile/annex/265/AS58_pJGv1T.pdf?source=pqars

- https://pmfby.gov.in/pdf/EoI_for_empanelment_of_WIP_under_YE_TECH_181023.pdf

***